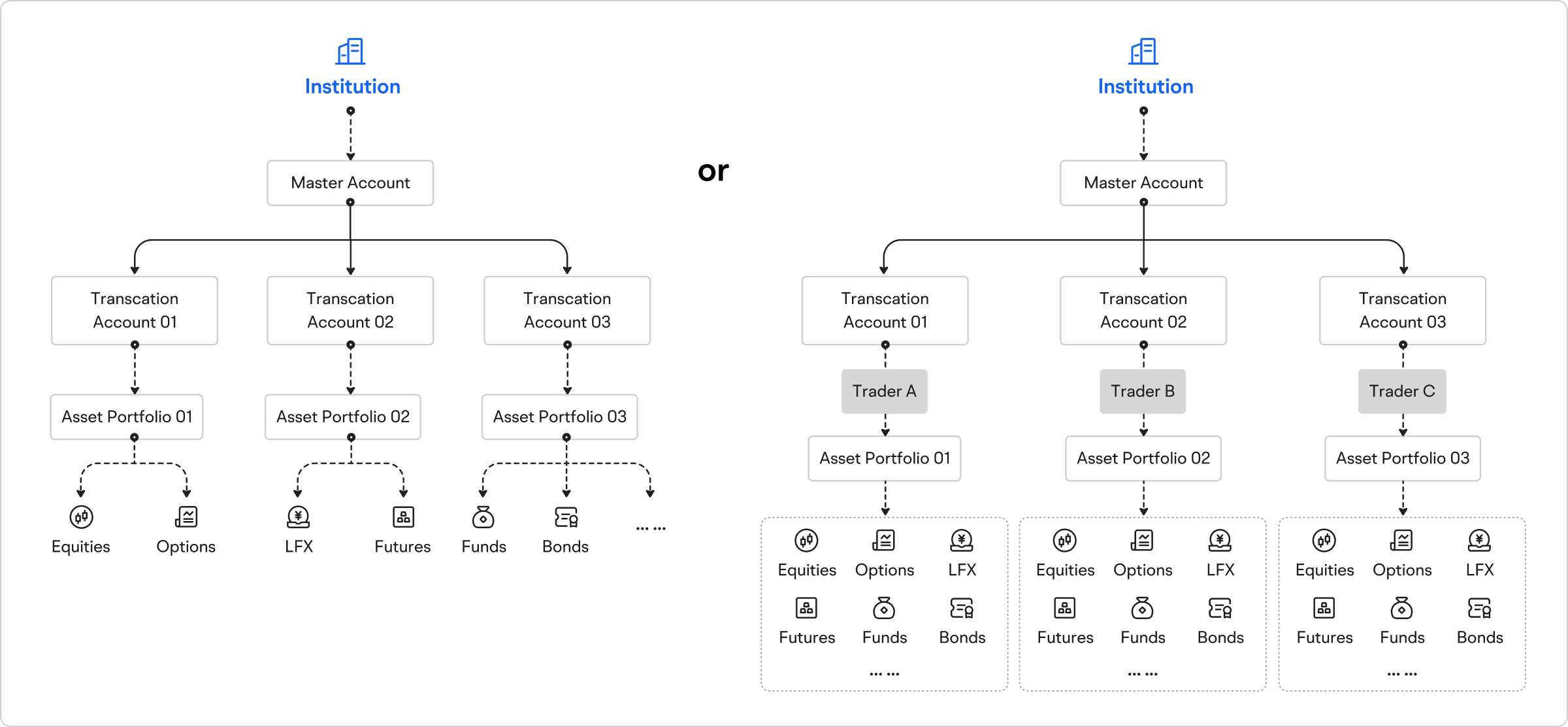

Diverse Investment Options

Stocks | Options | OTC ADRs | ETFs

Stocks | Options | Warrants | CBBCs | ETFs | Cryptos

Stocks | ETFs, Leveraged ETFs

Stocks | ETFs, REITs

Shanghai-Hong Kong Stock Connect | Shenzhen-Hong Kong Stock Connect

MMFs | Short-Term Investments | Bond Funds | Equity Funds | Mixed Funds | Private Equity Funds

A50 Futures | Hang Seng Index Futures | CME Futures | SGX Futures | Osaka Exchange Futures

Corporate Bonds | Municipal Bonds | Financial Bonds | Government Bonds

Hong Kong:+852 2301 8999(Ext.5300)

Hong Kong:+852 2301 8999(Ext.5300)

Hong Kong:enquiry@futuie.com

Hong Kong:enquiry@futuie.com