On January 25th, Futu I&E, in collaboration with the HKU Business School Alumni Association (HKUBSAA) , co-hosted "The insight forum on Global Dynamics and Emerging Opportunities in 2024" to jointly explore the global economic trends and new investment opportunities in the Middle East for 2024.

In this event, Yang Liu, Associate Professor at HKU Business School, delivered a keynote presentation on "International trade and investment trends shaping the 2024 global economy and the Hong Kong linked exchange rate system", offering a comprehensive interpretation of the global economic development trends and the crucial role of the Hong Kong Linked Exchange Rate System. This article distills the core perspectives from the dialogue to share with our audience.

Global Macroeconomic Trends and China's Economic Recovery

Over the past four years, the COVID-19 pandemic has severely impacted global economic development. While discussions around a potential US economic recession have been ongoing, the US appears to have been relatively unaffected. In contrast, China's economic growth has significantly slowed, challenging its long-term upward trend.

Market expectations suggested that 2023 would be a year of recovery, yet the actual performance did not align with these predictions. It seems the global economy is gradually entering a 'new normal', which means previous high growth rates are unlikely to be repeated, and future development is shrouded in uncertainty. It has become clear that our past forecasts were overly optimistic, and we must now face the reality of an era of slowed economic growth. Regarding expectations for 2024 and the coming years, the market generally anticipates a stable trajectory, without the so-called 'revenge growth'.

Looking at China, in 2023, the real estate sector was undoubtedly one of the biggest challenges for the Chinese economy. Data shows the industry is at a historical low — with declines in both new housing construction and sales, affecting related investments across the industry chain. Although the government has implemented various measures, such as local debt and fiscal support, resulting in some indicators rebounding, the durability of this policy-driven recovery merits further observation.

Unemployment is another significant issue China cannot ignore in 2023. The persistently high unemployment rate, at one point, led to an official halt in updates. It remains particularly high among the 16-24 age group, who struggle to find work or educational opportunities. Most Chinese families have invested heavily in education over the past decade, but the current dismal job market is undoubtedly disappointing and demoralizing. Unemployment and job difficulties have a massive impact on consumer sentiment; when people feel uncertain about the future, their desire to consume decreases, further negatively impacting the economy.

Stock Market Decision Factors: Economic Indicators, Market Expectations, and International Investment

Although we all pay close attention to various economic indicators, hoping they will positively influence investment decisions, a historical review (comparing GDP growth and stock market data between China and the US) reveals no particularly close correlation between economic growth and stock market performance. Listed companies are only part of the economy and do not fully reflect the actual economic situation; the stock market's performance results from multiple factors.

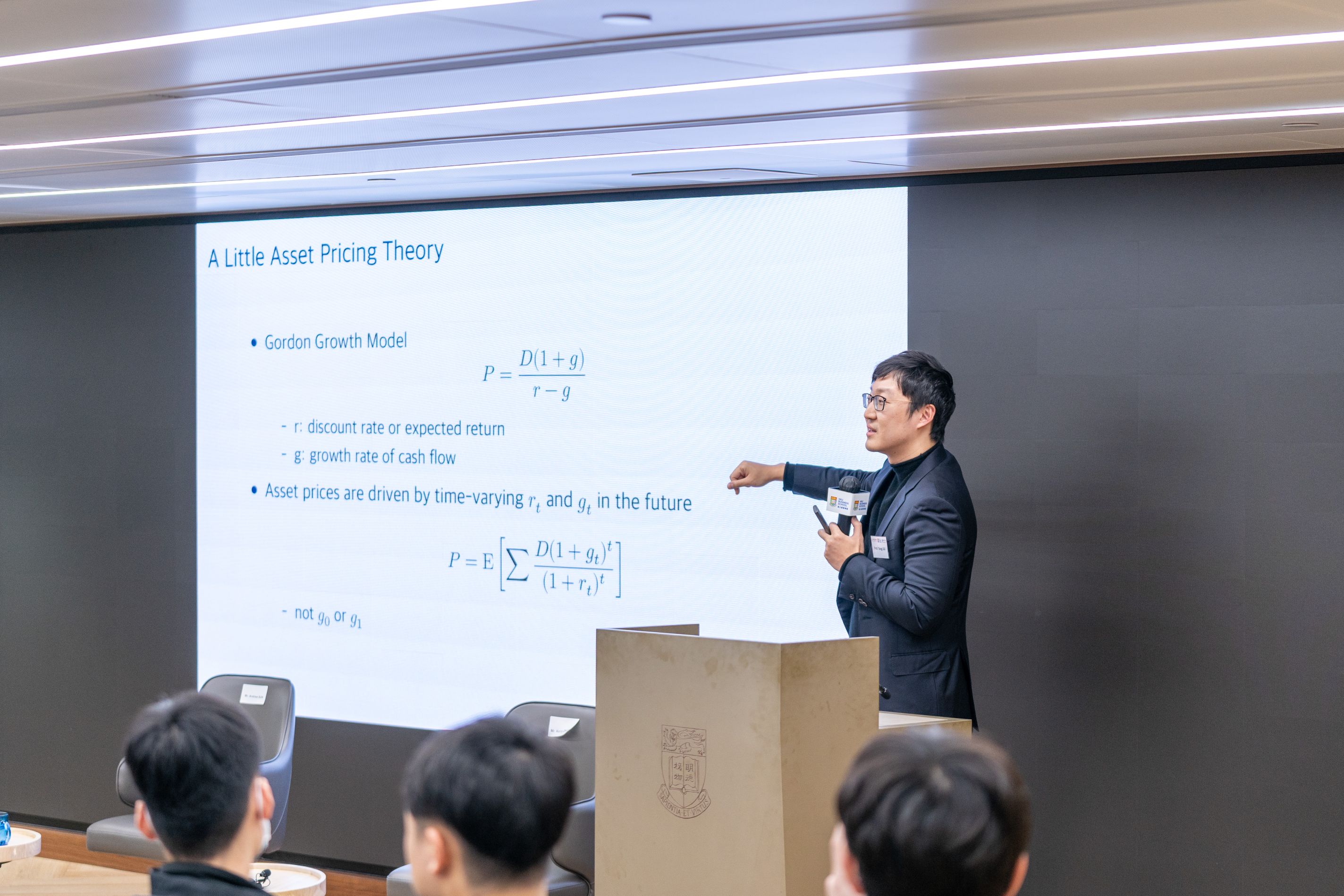

According to the Gordon Growth Model (also known as Gordon-Shapiro Model), stocks are considered future cash flows that grow at a certain rate (g), and investors need to calculate the present value of cash flows based on a discount rate (r). However, in reality, the growth rate (g) and discount rate (r) are continuously changing and play a key role in stock pricing. This clearly demonstrates that there is no direct link between GDP growth and stock prices.

In the secondary market, different groups have drastically different expectations for the same asset. This variance is particularly pronounced in the Hong Kong stock market, where the tug-of-war between Chinese and foreign capital, and the capital flow between the southbound and northbound trades, makes the stock market performance a result of the collective actions of all participants — the 'louder voice' has higher pricing power.

Furthermore, China and Hong Kong have indeed experienced an outflow of Foreign Direct Investment (FDI) in recent years due to the trade war, the COVID-19 pandemic, and the Russo-Ukrainian War. Many international companies are considering relocation or changing investment locations, with flows moving towards the US, Europe, and some emerging Asian markets. While many worry that the outflow of foreign capital will negatively impact Hong Kong's financial market, one might consider that if foreign investment withdraws, Chinese investors will have a higher pricing power in the Hong Kong market. This might put some pressure on stock prices in the short term, but in the long term, if the market is dominated by optimistic investors, the probability of a rise in related stocks and assets will be greater.

Furthermore, data indicates that the outflow of funds has not been as substantial as the market had imagined. As of the third quarter of 2023, Hong Kong's investment portfolio has essentially returned to pre-pandemic levels, reflecting that investor sentiment is not as pessimistic as it may seem on the surface. Even during the most tense periods of US-China relations, investments did not completely withdraw from Hong Kong as many had anticipated.

The Importance of Maintaining the Hong Kong Linked Exchange Rate System

The volatility of global interest rates over the past year has reignited market discussions about the Hong Kong Linked Exchange Rate System. Some believe that the system has operated stably for 40 years, ensuring the effective functioning of Hong Kong's finance; others view the system as uncertain, likely burying hidden risks for Hong Kong's economy. In my view, the Linked Exchange Rate System has faced more challenging crises in the past and has withstood them; therefore, it should have no problem now.

The Linked Exchange Rate System plays a crucial role in the stable operation of Hong's Kong's economy. On one hand, it expands the scale and channels of financing for investors, effectively attracting those interested in the US dollar and reducing borrowing costs. On the other hand, it significantly reduces exchange rate risks, as Hong Kong companies issuing US dollar bonds do not need to worry about the perils brought on by exchange rate fluctuations.

There is considerable market discussion about the possibility of decoupling the Hong Kong dollar from the US dollar and adopting a floating exchange rate system. Estimations suggest that if the Hong Kong dollar were to decouple from the US dollar, financing costs could rise by 2%, directly impacting financial transactions and new stock offerings, and indirectly causing a severe blow to Hong Kong's financial industry and GDP (with the financial sector accounting for up to 20% of Hong Kong's GDP). Although the decline in Hong Kong's US dollar foreign exchange reserves raises some concerns, it is still relatively safe compared to the money supply. Choosing to decouple from the US dollar would introduce exchange rate risks for Hong Kong, potentially leading to severe GDP fluctuations.

Moreover, even if Hong Kong were to adopt a floating exchange rate system, it would not necessarily achieve complete autonomy in monetary policy, given the close interconnection of global financial markets and the impact of other countries' policy changes on Hong Kong. Therefore, for Hong Kong, which is highly dependent on finance and international trade, the stimulating effect of monetary policy is relatively limited.

Regarding the potential pegging of the Hong Kong dollar to the renminbi, we can consider from three perspectives: First, it could damage the independence of Hong Kong's currency under the "one country, two systems" framework; second, although the use of the renminbi in international trade has increased, its pricing power and circulation volume in the global monetary system have not yet reached the level of the US dollar; and lastly, such a move could likely face capital attacks, leading to systemic risks, and would require substantial funds from the mainland to maintain exchange rate stability.

Disclaimer: The content of this article is for reference only and does not constitute financial, legal, tax, investment advice, or any other form of advice. It should not be relied upon as the sole basis for making any financial, tax, or legal decisions. Any consequences resulting from actions taken based on the information and opinions expressed in this article are the sole responsibility of the individual taking such actions and are not related to Futu I&E.

Shen Zhen: 0755-86636688(Ext.8683)

Shen Zhen: 0755-86636688(Ext.8683)

Shen Zhen: service@futuie.com

Shen Zhen: service@futuie.com